22/12/2022

Central Banking as we know it today is a relatively new inception which has only been around since the mid 19th century; however the term was previously used to refer to the primary branch of any private bank since the 1600s.

The scholar Stefano Ugolini of Toulouse University wrote in 2017 that central banking is aimed at “the provision of public policies aimed at fostering monetary and financial stability”. My understanding is that it has done exactly that, but the meaning of stability is not what it seems.

Inflation cartels, as central banks are often referred to on Twitter, have been incredibly successful in maintaining monetary stability by ensuring that seemingly few fiat currencies have collapsed altogether, and they have ensured a steady and (for the most part) stable decline of purchasing power over time.

The term “inflation” has been redefined by central banks in recent years to simply mean the increase of prices of goods and services, which they measure using a faulty metric: Consumer Price Index (CPI).

The original definition of “Inflation” was simply: The inflation (expansion) of the money supply. Since Central Banks around the world have absolute control over the production of their currencies, they completely and utterly control inflation, as when more currency is in circulation competing for the same amount of goods, prices will increase due to higher bids from people holding that currency - of course a change in the supply of goods also results in price changes, but the rate of printing has vastly outpaced most production growths of products over the past 5 decades. This essentially means that the inflation cartels which print money are robbing everyone who holds those currencies of purchasing power, which is often likened to a tax on people. This is done because higher direct taxes on people would result in dissent from the people, and this inflation '“tax” can easily be blamed on things like wars or greed of producers and merchants.

CPI, which is used to keep track of inflation is often vastly skewed and underrepresents the true severity of inflation for two main reasons:

CPI tracks a basket of goods which average people consume, which means that it could easily exclude goods that you personally consume which have undergone much higher price increases.

The CPI is flawed in that the basket changes each year; meaning that because it tries to track the average goods that people consume, when prices increase and people are forced to switch to cheaper alternatives such as replacing olive oil with canola Oil, the CPI will start to measure the price of canola oil compared to the olive oil from the year previously, thus the inflation looks a lot less severe than it should actually be, as real standards of living drop but the number doesn’t actually measure the real price changes of like products over years.

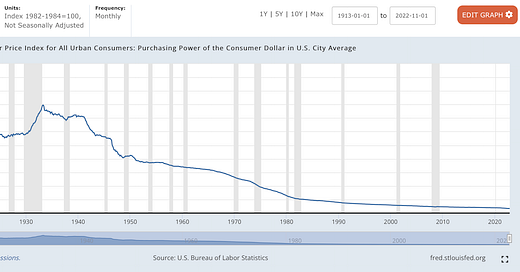

Despite that the CPI fails to take into account the true extent of the decrease in purchasing power for the consumers, the chart shown below taken from Federal Reserve Economic Data (FRED) shows a dreary picture as it is:

This printing is done to maintain this stability, but the stability that it refers to is only the central control and the ability to have additional “taxes” which fund warmongering (such as in Afghanistan and Iraq) and other projects which garner public support such as (grossly overpriced) public services like healthcare and schooling.

The amount of printing that has been done over the past few years is staggering as shown in this chart depicting the number of US Dollars in circulation over the past 25 years:

Central Banks use money printing as one of their main tools, but they also have interest rate changes to help them balance this. When they inflate the economy too much, as they can’t seem to keep track of how much they print, they increase the interest rates for their currencies - which is exactly what Jerome Powell is doing at the moment.

Interest rate increases cause people to have a higher demand for dollars which supports the strength of that currency. But it increases the cost of loans, damaging people’s ability to repay loans for studying, buying homes and so forth - pushing people further into the debt-slave economy.

They can’t continue to do this forever; however much it has looked like it for the past 51 years that they have been able to balance this. World Governments are, at least for the most part, all indebted to one another such as the US government who is at time of writing around 31.5 Trillion Dollars in debt to other nations, and with the increases in interest rates they start owing more and more on that debt, until eventually their creditors call them out and ask for their money to be repaid, when these governments can only print more money to repay their debt, or default on their loans.

Unfortunately we sit in a position where currency today, fiat currency, is not based on any commodity (such as Gold in the past) but all are based on the global reserve currency of the US Dollar, and most sovereign debt is denominated in USD itself, so the more debt that the US government has, the more they are incentivised to print more and devalue their own currency so they have to pay off less actual value in the end.

Other countries have finally begun settling trade in other currencies and commodities with the rise of the Chinese Renminbi, the use of gold and Bitcoin to achieve settlements, especially in the past two years.

Eventually, many countries will shift away from the USD and as such their system will collapse - this is the sovereign debt bubble which has been aching to pop.

The governments in charge of their currencies are looking at the stability in terms of maintaining their hegemony over whichever trade they have and their dominance over everyone using their currency, however all fiat currencies have declined notably in purchasing power over time as a result of these actions and as such have harmed the individuals who have tried to save for their futures.

These actions have forced non-professionals to invest their savings, or pay exorbitant fees for professionals to invest their money for them, which many Keynesian economists believe is very good as it promotes industry growth in the immediate term - however this reduces the liquidity of people’s finances and limits people’s ability to invest in the future or have access to their funds in an emergency - again harming the individual senselessly.

Inflation cartels do not serve the people or their financial wellbeing, they serve to uphold the dominance, but not strength, of currencies that people are forced to use as legal tender and to pay their taxes in.

People now have a choice to opt out of that system, I recommend researching Bitcoin which is the only form of money which can never be inflated beyond the mathematically ensured fixed supply and is not controlled by any central authority. I am not a financial advisor, however from where I stand - living in the debt-slave economy where we are forced to take out loans we can never repay will keep everyone poor, whereas using a form of hard money will be beneficial for everyone.