Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless. - Milton Friedman

The word “fiat” is defined as “a decree”. Fiat currency is money by decree from our governments. Beyond being forced to pay our taxes in it or threats of imprisonment in some places for using alternatives, the decree that scraps of paper, or digitalised representations thereof, have longterm economic value is doubtful.

The US dollar, which is often regarded as the “King” of fiat currencies - or simply as the world’s reserve currency - is down significantly from all-time highs, and with the United States Federal Reserve’s head, Jerome Powell, increasing interest rates has caused speculators and bottom-feeders to rush into the market and sending the price rebounding somewhat. This however should be no cause of any enthusiasm, as a small spike for an asset that is down 96.7% and falling on average every day as its universal truth is something alarming.

Many thought that the dollar would remain the standard for the rest of civilisation, but it has been on an alarming trajectory to 0 since 1913. This accelerated drastically in 1971 when the world moved away from the gold standard. Many people’s hopes were dashed when the experimental currency had a protocol update shifting it away from a representative currency to a fiat one.

The dollar however is still making millionaires and billionaires frequently - the problem lies in the fact that those denominations begin to mean less every day. With a million dollars being worth 97% less today than it was in 1913, even those shiny titles of wealth have become increasingly commonplace and lost their appeal somewhat.

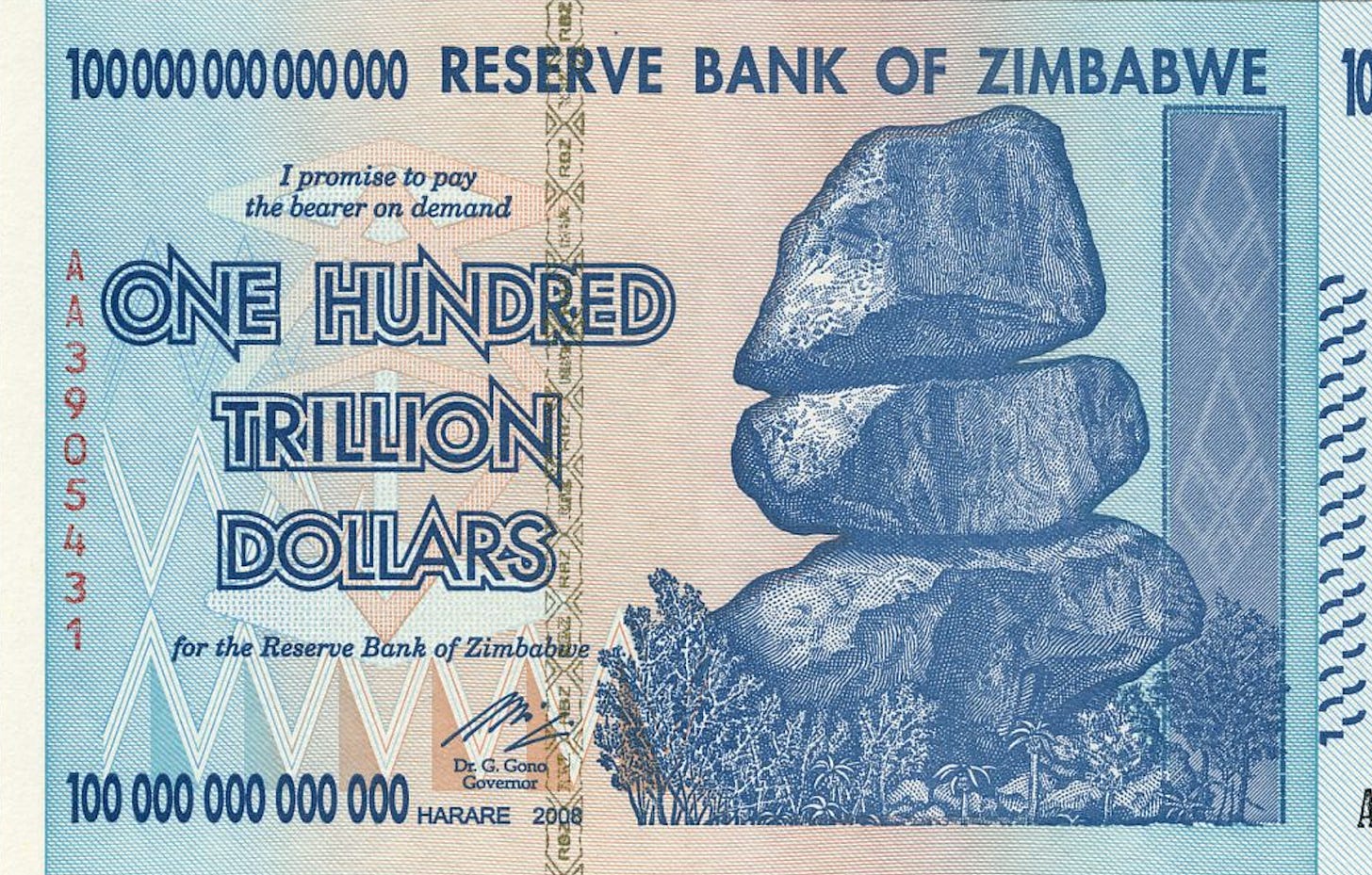

The hyperinflation seen in Zimbabwe caused the currency to fall so drastically that almost everyone was at least a billionaire. Many trillionaires were around as well - often even including beggars on the streets who were forced there by virtue of this economic enslavement to fiat money.

We are living in an experiment that has lasted 51 years too long; the dollar standard was designed to fail from its outset, as it is based on stealing value from the people that are forced to use it - until they have nothing left to steal. The dollar is designed to lose purchasing power over time in what can be seen as a slow-burning rug pull; where some insiders (the money printers) are able to accumulate others wealth over time, while the users are left poorer and poorer each moment that they hold fiat currencies; often without questioning the cause.

A 1.7 Trillion US Dollar spending bill was recently proposed, and there is a misconception that this is taxpayer funded - when in reality the value is taken from anyone who holds US currency: from the US taxpayers; international governments; the citizens of countries who dollarized and anyone who holds dollars for any reason at all.

This spending bill is just part of the perpetual printing machine which has been sped up or slowed depending on how readily people realise that they are being scammed with inflation rates varying in magnitude, but always rising.

The dollar has always faced a gradual slide into nothingness, but with mounting competition from a harder form of money (Bitcoin), the counter-active incentive to print more rapidly is mounting and the devaluation of all fiat currencies will start becoming exponential as it did or has begun doing in the Weimar Republic, Zimbabwe, Bolivia, Venezuela, Argentina, Lebanon, Turkey - not to mention every other instance of fiat currency. Of the 775 fiat currencies reported in history, only some of the newer ~180 of them remain today as they have a tendency to creep towards zero until their rapid demise.

The people in nations where this is currently happening need Bitcoin sooner, as it is the best performing asset of the decade and its operation cannot be influenced or disrupted by any external party. Your Bitcoin cannot be stolen from you if you hold your own Bitcoin keys. Yes, even with the recent ~80% drawdown, it is still outperforming many fiat currencies this year alone and looks to continue outperforming fiat for at the very least the next few decades. That is not a metric that should be a sign of success on the part of Bitcoin, but rather a complete and utter failure of the dollar and other fiat to preserve wealth of its users over time.

Bitcoin adoption has started rapidly in the developing world, but the many Euro-American centric journalists proclaiming its death, such as Ross Clark’s article for which this article is somewhat parodical, will likely be the last people to realise Bitcoin’s value over time. Good luck to them.

The dollar has aided and abetted criminals; has been the cause of war crimes around the world; and is used primarily as a conduit for users to snort their drugs more than it has ever served as a good money or store of value. I will not miss the dollar standard, nor the nightmares it brings.